Indonesia’s economic growth slowed sharply in Q1 of 2020 amid fear of coronavirus spread, which would take a heavier toll on Southeast Asia’s biggest economy in months ahead. According to Indonesia export data, Gross Domestic Product (GDP) rose to 2.97% in the first quarter from a year ago, this was weakest since 2001. Let’s have a wider perspective of Indonesia’s growth impact by Covid-19 and its export market from Indonesia export statistics.

GDP contracted 2.41% in the first three months of 2020, as compared to quarter of previous year, which was worse than the 1.27% contraction expected by economists. Indonesia may also slip into a technical recession as second-quarter performance will be hit hard by a partial lockdown adopted to contain the novel coronavirus pandemic in Southeast Asia’s biggest economy. A technical recession is defined as two consecutive quarters of GDP contraction.

The International Monetary Fund (IMF) in April 2020 World Economic Outlook forecasted the 0.5% growth in Indonesia’s economy, joining the ranks of China and India.

Indonesia has the second-highest number of Covid-19 infections in Southeast Asia next to Singapore. It went to a partial lockdown from 10th April and social distancing will continue into the country.

Outlook Uncertain

As coronavirus has affected global economies including Indonesia severely & it is likely to remain in the lives of people this year until vaccine is prepared; there is uncertainty in the growth projection. According to business researchers, Indonesia’s GDP is likely to slash to 2.3% from 5.3%, which could contract under a worst-case scenario.

Other stats from Indonesia customs data are:

- Indonesia exports increased just 0.24% from a year earlier.

- Government spending increased 3.74%.

- Gross fixed capital formation climbed 1.7%.

- Household consumption increased 2.84% in the first quarter from a year ago.

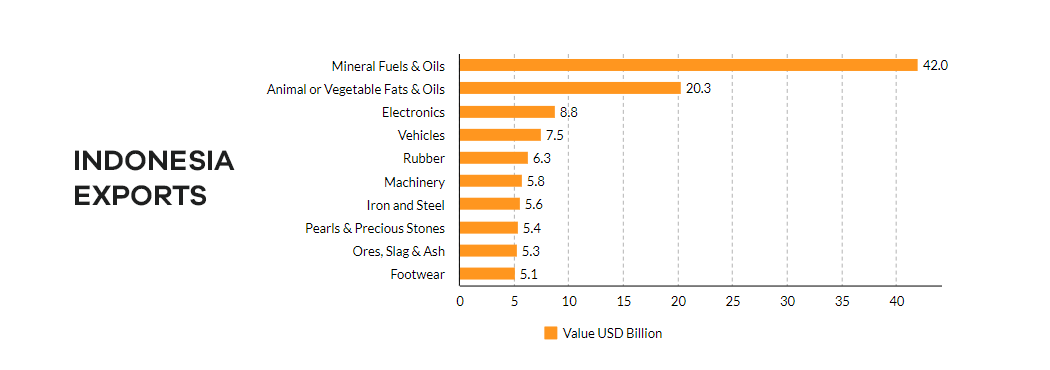

Indonesia Exports

Indonesia’s total exports valued USD 180.2 billion in 2018, which rose in 2019. However, 2020 looks weakest year as international trade has been restricted from March due to spread of coronavirus. If we look at major exports of Indonesia, the country shipped mineral fuels and oils the most in 2018. Besides, animal or vegetable fats & oils including palm oil, electronics, vehicles and rubber were other major goods supplied by the country at 2-digit level HS Code. Here is a list of Indonesia’s top 10 exports with their dollar amount recorded in 2018.

|

Product

|

Value USD Billion

|

|

Mineral Fuels & Oils

|

42.0

|

|

Animal or Vegetable Fats & Oils

|

20.3

|

|

Electronics

|

8.8

|

|

Vehicles

|

7.5

|

|

Rubber

|

6.3

|

|

Machinery

|

5.8

|

|

Iron and Steel

|

5.6

|

|

Pearls & Precious Stones

|

5.4

|

|

Ores, Slag & Ash

|

5.3

|

|

Footwear

|

5.1

|

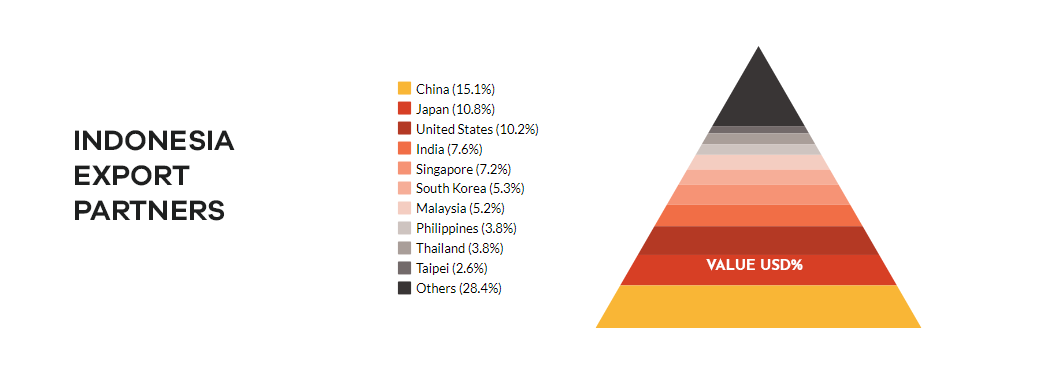

Indonesia Export Partners

Indonesia’s largest export partner is China, which shared 15.1% of total value in 2018, which rose in 2019. Due to coronavirus originated in China, many countries including Indonesia are planning to restrict trade with China. As a result, Indonesia trade with China is likely to decline substantially in 2020. Japan is the second largest export destination of Indonesian goods. Below given chart and table shows Indonesia’s top 10 export partners with their share in values recorded in 2018.

|

Country

|

Value USD %

|

|

China

|

15.1

|

|

Japan

|

10.8

|

|

United States

|

10.2

|

|

India

|

7.6

|

|

Singapore

|

7.2

|

|

South Korea

|

5.3

|

|

Malaysia

|

5.2

|

|

Philippines

|

3.8

|

|

Thailand

|

3.8

|

|

Taipei

|

2.6

|

The coronavirus has not only impacted the economy of Indonesia but business of other countries as well. Millions of people are affected with Covid-19 and industries have been more or less shut due to extended lockdown. Certainly, many research agencies have predicted negative growth for many countries in 2020. Indonesia too will have slow economy growth in this year, although improvements are likely from July.